Linklaters is known across the industry for being tight-lipped on its U.S. strategy.

That could be because, up until now, its approach to the largest legal market in the world has been relatively muted against its noisier rivals, especially the soon-to-be merged Allen & Overy and hiring-happy Freshfields Bruckhaus Deringer.

Before this month, the firm’s most significant U.S. hires came in the shape of two partner additions in New York and a senior counsel in Washington D.C. Despite the calibre of the new joiners, the moves were seen more as a bid to develop the firm’s energy and infrastructure expertise, with little indication that they were intended as a U.S. market-breaking move.

That same year, one Linklaters partner even suggested that the firm was “not really set up to compete on domestic work in the U.S.”.

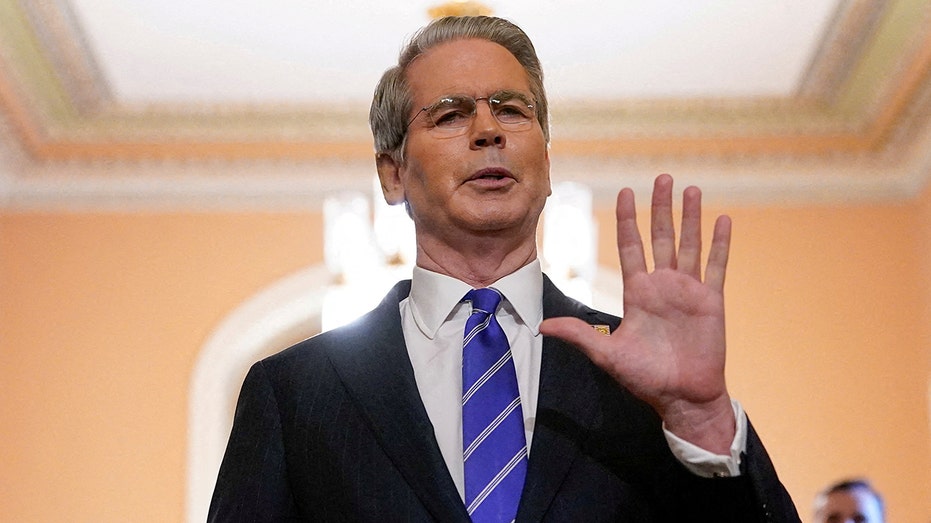

But Linklaters acquisition of a six-strong M&A team earlier in January, led by Shearman & Sterling’s co-managing partner George Casey, has prompted questions about whether this is the first step to a wider U.S. expansion, and a move to finally catch up with the chasing pack.

Could this overturn some of the pretty derisive opinions on Linklaters’ U.S. foray so far?

Law.com International spoke with Linklaters partners, rival partners and consultants to understand more about the likely outcome of the move for Casey, and whether the firm’s struggles with breaking the U.S. are reflective of a lack of ambition, an inability to catch up with its rivals, or indeed whether it is indicative of a wider challenge facing U.K.-founded firms attempting to crack the U.S. market.

Behind the Pack

Looking at its latest LLPs, Linklaters’ Americas client contracts had generated for the firm around £122.2 million in 2023.

A quick comparison shows that, that same year, Clifford Chance and Allen & Overy generated £268 million and £287.5 million respectively across the same region. And in 2022, Freshfields generated more than £100 million more than this in its U.S. offices alone with £224.5 million.

Ask say a Paul Weiss Rifkind Wharton & Garrison or a Sullivan & Cromwell what they think of these figures, neither are likely to balk. But the firms’ growth strategies, particularly that of A&O, with its impending Shearman merger, and Freshfields, which grew its U.S. revenue by 30% in the 12 months to 2022, bear consideration.

The response to the hires of Casey and co has been largely lukewarm.

A London-based M&A partner at a large U.S. firm said it was “an interesting move” but “not a surprising one”.

“They are behind, especially when compared to the rest of the ‘magic circle’. It’s not surprising that they are doing something since they’ve been trying to make a push but haven’t made a mark so far.”

The person added that “you can’t ignore how important the U.S. is in the market and how many deals are now international in nature. It’s imperative to have an all rounder practice.”

An ex-Linklaters corporate partner agreed that the hires were a positive effort but that the firm has a long way to go.

“It’s obvious that all English firms are behind in the U.S. But it’s good to see Linklaters do something. Having said that, I don’t think they will not become a major competitor in the U.S.”

But the partner indicated that this was more than simply a Linklaters problem.

“It’s impossible to really break the U.S. market for ‘magic circle’ firms because the U.S. firms are dominant on different economic footings. These English firms have no brand recognition in the U.S., so unless they go for a merger like the A&O and Shearman, I don’t think this is significant.”

Though the firm’s U.S. ambition has at times been questioned, it has at points implemented changes that some have interpreted as a bid to raise its profile and its ability to recruit partners that can make an appreciable difference to the firm’s top line.

In 2021, it followed Freshfields and others by modifying its lockstep model which more closely aligned its pay structure with those adopted by a number of U.S. firms. Partners at the time welcomed the change, several suggesting the move would enable the firm to expand and compete in the U.S.

Not About Competing?

There is a broad assumption that Linklaters hired Casey as a precursor to a wider U.S. expansion—a pre-compete move. But what if this is a mistaken view?

One top London recruiter believes that the move for Casey was “more about establishing a well-structured business than chasing the [U.S.] top 10”.

“It’s very likely the firm isn’t thinking about competing with the big U.S. names, but wants to establish itself in a way that works for the wider business,” the person said.

Another person close to the firm said that key for the firm now was maintaining profitability, so rapid expansion was not top of the agenda.

Indeed, last year, Linklaters recorded a 4.9% decrease in its average PEP figure, which the firm attributed to “material exceptional costs” relating to the closure of the firm’s Moscow office.

Another rival partner at a large transatlantic firm summed up the market mood that the move for Casey was “interesting more than competitive”.

“It’s more indicative of where they are going rather than considering them as active competition for transatlantic deals at this time,” the person said. “They’ve been trying to grow in the U.S. for a long time and it’s extremely difficult to do this organically.”

In response to the points made in this article, Linklaters reshared its statement on Casey’s hire.